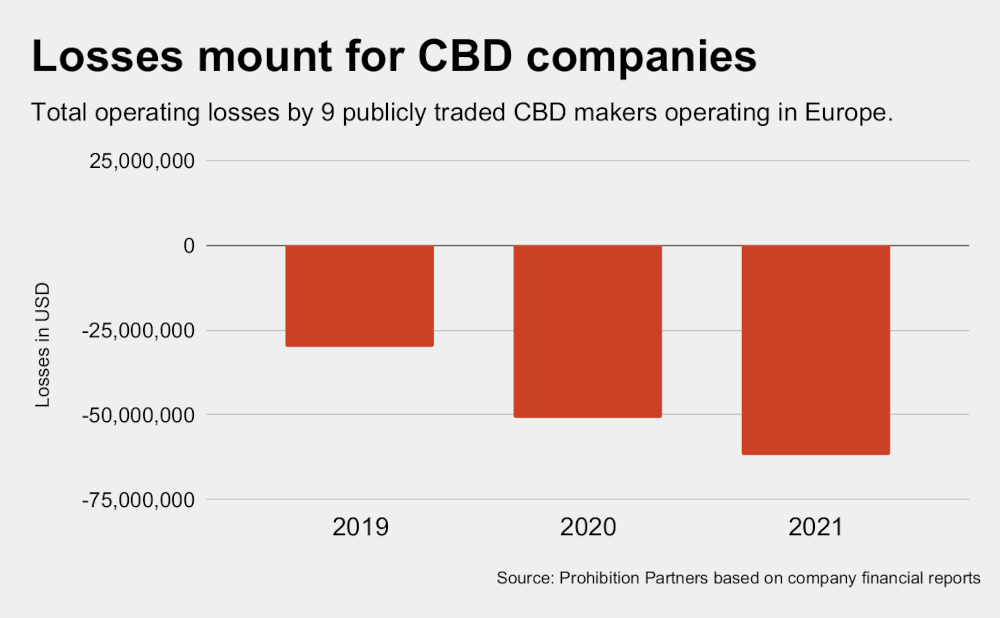

A drastic imbalance between revenues and expenses shows publicly traded companies are overstretched in the European CBD market and continue to rack up massive losses, a UK cannabis analyst says in a recent report on the sector.

Eleven public companies researched by London-based Prohibition Partners had combined operating losses of €62 million for 2021. Six of those companies increased their operating losses by an average of 400%, while losses of three others averaged 65% that year, according to the report.

“Virtually no public company operating in the European CBD market is making an operating profit as of mid-2022. Indeed, as the number of operators increases and they each increase in size, the losses are mounting,” the report observes.

‘Early’ market

“This is attributable mostly to the early nature of the market, and the fact that most companies are still fighting for market share before regulations which properly support the industry are in place,” the report observes, calling the results of its study “troubling for those involved in the sector.”

“It should be noted that most companies are making less than €10 million in revenue per year, which speaks to the drastically fragmented market in European CBD,” the analyst said.

Stakeholders in Europe are pushing national authorities to set regulations for CBD after the European Commission ruled in 2020 that the compound is not a narcotic, can be qualified as food, and that CBD products should enjoy the same free movement of goods between and among member states as other legal products. But changes are coming slowly.

In the UK, CBD makers submitted nearly 12,000 CBD products to the Food Standards Agency’s process for approval of new or “novel foods.” That process has been troubled and also slow to develop, and the delays have contributed to some publicly traded companies being on the ropes.

Who will survive?

Meanwhile, amid the shortage of specific laws and regulations for CBD, the gray market continues to flourish across Europe and the UK, the report notes.

“CBD is now potentially the largest CPG (consumer) product in Europe which is, in the majority, sold under legally ‘grey’ conditions,” the authors write. “This situation is evolving fast, with new laws, regulations and enforcement practices changing at the European and national level on a quarterly basis.”

As those rulemaking and certification regimes develop, only producers which turn out high-quality products and are working their way down regulatory pathways, will survive, Prohibition Partners predicts in the report.

“Operators who are currently self-regulating to high standards or are participating in the novel foods applications will be the ones who will still be operating in five years,” the analyst writes.

Retail prices rebound

Retail prices for CBD products have returned to or surpassed 2019 prices after dipping roughly 25% in the intervening years, according to the report. That’s despite the fact that the cost of hemp flower biomass used to make CBD has plunged by as much as 75% since 2019, a reality the Prohibition Partners report gives short treatment. Some companies seeking to meet upcoming standards in Europe and the UK may be keeping prices high to recover costs associated with regulatory compliance, the report suggests.

In other observations, Prohibition Partners said:

- The vast majority of revenue in the CBD sector is being captured by private companies without any obligation to report to anyone.

- The CBD supply chain is likely to shift somewhat back towards European producers as the number of producers in the U.S. gradually declines and the EU’s Common Agriculture Policy continues to protect farmers from low-cost areas for cultivation.

- Fifty-one percent of current users surveyed said they expect to consume the same amount of CBD in the next 12 months as they did in the last 12 months.

- Large online marketplaces like eBay and Amazon are expected to offer full suites of products to European consumers.

[Download the Prohibition Partners report]

Read the full article here